The UK is presently sixteenth out of fifty European international locations when it comes to the perfect pension providing. Linda Bestwick/Shutterstock

A query that’s perennially requested by monetary specialists is: “can the federal government (in different phrases, the taxpayer) afford to maintain growing pensions?” But in my opinion, the actual query needs to be: “what’s the goal of the state pension?”

This isn’t an economics query, it’s an ethical query. And, as a society, we’re poor at discussing ethical questions.

A report from the Office for Budget Responsibility earlier this 12 months acknowledged that within the present monetary 12 months, the state pension will value round £124 billion. This is greater than the £105 billion schooling funds and greater than double the £52 billion defence funds.

The stage of the UK pension is safeguarded by the triple lock, which was first launched within the June 2010 funds. It means annual will increase in funds are made consistent with earnings development, worth inflation (presently 4.6%) or 2.5% – whichever is highest.

With one other triple lock improve of 8.5% in pensions due in April 2024, the state pension will rise to £221.75 per week (£11,531 each year). This is just £20 per week lower than the non-public allowance everybody can earn earlier than having to pay tax or nationwide insurance coverage.

Assuming wages exceed inflation and a couple of.5% consistent with the final 5 12 months averages, then the pension up-ratings may very well be within the area of 5% in 2025 and 2026. This will see pensioners, who haven’t any different revenue, having to pay tax – in some circumstances, a decade after they final paid revenue tax.

So, how will we be sure that retired individuals are in a position to have a cushty way of life as soon as they cease working? As a place to begin, we are able to contemplate precept 15 of the European pillar of social rights, which was set out in 2017 by the European Union and maintains: “The proper of staff and the self-employed to a pension commensurate with contributions and guaranteeing an enough revenue. The proper to equal alternatives to accumulate pension rights for each men and women. The proper to sources that guarantee dwelling in dignity in previous age.”

Comparing incomes

The nationwide dwelling wage is 2 thirds of UK common earnings and needs to be the minimal to cowl “enough revenue” and “dignity in previous age”. The wage obtained by an grownup working 37 hours per week on the nationwide dwelling wage is presently £10.42 per hour. This will improve to £11.44 per hour from April 2024.

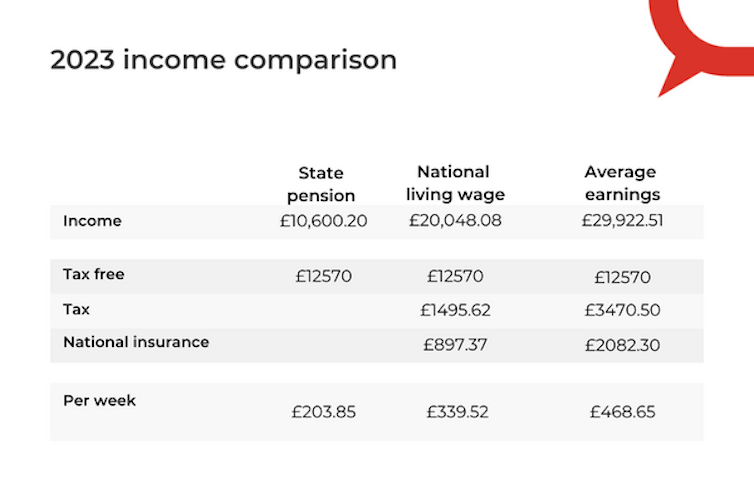

A comparability of the state pension, nationwide dwelling wage and common earnings within the UK in 2023.

Were the UK pension matched with the nationwide dwelling wage, it will be set at a determine of £22,308 per 12 months, and pensioners’ revenue can be vastly totally different as of April 6 2024.

Even after paying greater than £1,900 in tax, the poorest pensioner can be nonetheless be £225.15 per week higher off than they’re at this time. And the additional disposable revenue may very well be recycled into the financial system by means of elevated expenditure, with knock-on impacts in oblique taxes akin to VAT.

A European comparability

A current survey by pension recommendation agency Almond Finance UK reveals the UK is presently sixteenth out of fifty international locations when it comes to the perfect pension providing throughout Europe. Spain tops the survey, with Belgium in second place and Luxembourg third.

Bringing the state pension consistent with the nationwide dwelling wage would transfer the UK as much as fourth place, forward of Bosnia and Herzegovina, Cyprus, Lichenstein, France, Denmark and Switzerland.

Such a rise would elevate the annual value to the Treasury from the present £124 billion to £236 billion. And such a big improve in expenditure would require extra taxes or extra borrowing, which might accrue extra debt curiosity in flip. But this sum may very well be lowered by £13 billion by charging pensioners nationwide insurance coverage.

In a response to a web-based petition in August, which referred to as for the state pension to be matched to the nationwide dwelling wage, the federal government stated it had “no plans to extend the state pension to equal 35 hours per week on the nationwide dwelling wage”. It went on to explain the state pension and nationwide dwelling wage as having “totally different functions” and stated {that a} direct comparability couldn’t be drawn between the 2.

With the concentrate on slicing each enterprise charges and nationwide insurance coverage within the autumn assertion, it’s price contemplating how these measures will assist to make sure that pensioners dwell in dignity in previous age.

![]()

Chris Parry doesn’t work for, seek the advice of, personal shares in or obtain funding from any firm or organisation that will profit from this text, and has disclosed no related affiliations past their educational appointment.