Pain, no achieve? Bank of England Governor Andrew Bailey. IMF, CC BY-SA

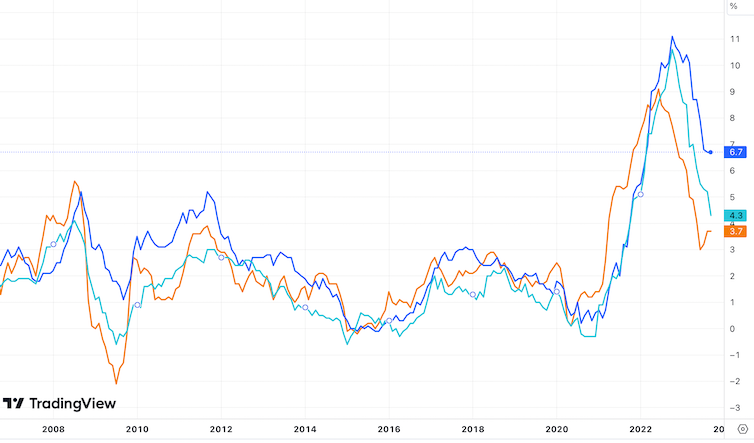

Inflation stays too excessive within the UK. The annual fee of client value inflation to September was 6.7%, the identical as a month earlier. This is effectively under the 11.1% peak reached in October 2022, however the failure of inflation to maintain falling signifies it’s proving much more cussed than anticipated.

This could immediate the Bank of England’s Monetary Policy Committee (MPC) to boost the benchmark rate of interest but once more when it meets in November, however in my opinion this is able to not be fully justified.

In actuality, the speed hikes that started two years in the past haven’t been very useful in tackling inflation, no less than indirectly. So what’s the issue and is there a greater various?

Right coverage, improper inflation

Raising rates of interest is the MPC’s predominant instrument for making an attempt to get inflation again to its goal fee of two%. The thought is that this makes it dearer to borrow cash, which ought to cut back client demand for items and providers.

The bother is that the kind of inflation lately witnessed within the UK appears much less an issue of extreme demand than as a result of prices have been rising for producers and repair suppliers. It’s often called “cost-push inflation” versus “demand-pull inflation”.

Inflation charges (UK, US, eurozone)

UK = darkish blue; eurozone = turquoise; US = orange.

Trading View

Production prices have risen for a number of causes. During the COVID-19 pandemic, central banks “created cash” by quantitative easing to allow their governments to run massive spending deficits to pay for furloughs and different interventions to assist residents by the disaster.

When nations began reopening, it meant individuals had cash of their pockets to purchase extra items and providers. Yet with China nonetheless in lockdown, international provide chains couldn’t maintain tempo with the resurgent demand so costs went up – most notably oil.

Oil value (Brent crude, US$)

Trading View

Then got here the Ukraine conflict, which additional drove up costs of elementary commodities, comparable to power. This made inflation a lot worse than it might in any other case have been. You can see this mirrored in client value inflation (CPI): it was simply 0.6% within the 12 months to June 2020, then rose to 2.5% within the 12 months to June 2021, reflecting the availability constraints on the finish of lockdown. By June 2022, 4 months after Russia’s invasion of Ukraine, CPI was 9.4%.

The coverage downside

This begs the query, why has the Bank of England (BoE) been elevating charges if it’s unlikely to be efficient? One reply is that different central banks have been elevating charges. If the BoE doesn’t mirror fee rises within the US and eurozone, traders within the UK could transfer their cash to those different areas as a result of they’ll get higher returns on bonds. This would see the pound depreciating in opposition to the US greenback and euro, in flip rising import costs and aggravating inflation.

Part of the issue has been that the US has arguably confronted extra of the kind of demand-led inflation in opposition to which rates of interest are efficient. For one factor, the US has been much less on the mercy of rising power costs as a result of it’s power self-sufficient. It additionally didn’t lock down as uniformly as different main economies through the pandemic, so had slightly more room to develop.

At the identical time, the US has been more practical at bringing down inflation than the UK, which once more suggests it was combating demand-driven value rises. In different phrases, the UK and different nations could to some extent have been compelled to observe go well with with elevating rates of interest to guard their currencies, to not combat inflation.

What subsequent

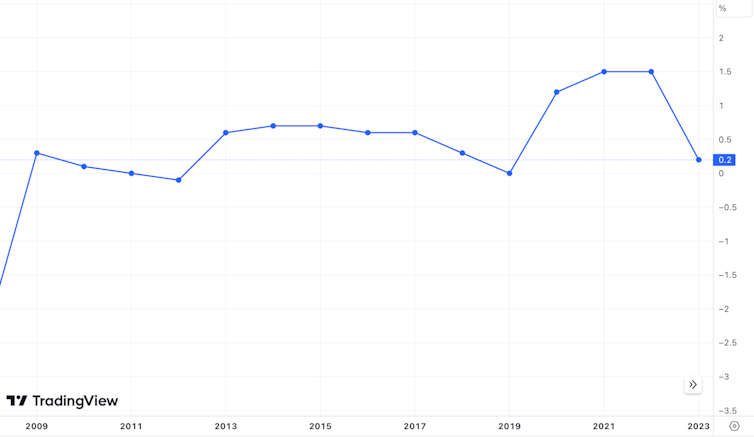

How dangerous have the speed rises been within the UK? They haven’t caused a recession but, however development stays very weak. Lots of persons are battling the price of residing, in addition to lease or mortgage prices. Several million persons are resulting from be hit by a lot increased mortgage charges as their fixed-rate offers finish between now and the tip of 2024.

UK GDP development (%)

Trading View

If mountain climbing rates of interest shouldn’t be actually serving to to curb inflation, it is smart to begin shifting in the other way earlier than the financial state of affairs will get any worse. To keep away from any harm to the pound, the reply is for the main central banks to coordinate their insurance policies in order that they lower charges in lockstep.

Unless and till this occurs, there would appear to be no fast repair accessible. One piece of excellent information is that the power value cap for typical home consumption was diminished from October 1 from £1,976 to £1,834 a 12 months. That 7% discount ought to result in client value inflation coming down considerably in direction of the tip of 2023.

More usually, the Bank of England could merely must hope that world occasions transfer inflation within the desired path. A key query goes to be whether or not the wars in Ukraine and Israel/Gaza lead to additional price pressures.

Unfortunately there’s a precedent for a Middle East battle resulting in a worldwide financial disaster: following the joint assault on Israel by Syria and Egypt in 1973, Israel’s retaliation prompted petroleum cartel OPEC to impose an oil embargo. This led to an nearly fourfold enhance within the value of crude oil.

Since oil was elementary to the prices of manufacturing, inflation within the UK rose to over 16% in 1974. There adopted excessive unemployment, leading to an unwelcome mixture that economists known as stagflation.

These days, international manufacturing is the truth is much less reliant on oil as renewables have turn out to be a rising a part of the power combine. Nonetheless, an oil value hike would nonetheless drive inflation increased and weaken financial development. So if the Middle East disaster does spiral, we could also be caught with cussed, untreatable inflation for even longer.

![]()

Robert Gausden doesn’t work for, seek the advice of, personal shares in or obtain funding from any firm or group that will profit from this text, and has disclosed no related affiliations past their educational appointment.