Wine stays amongst South Africa's main agricultural exports Getty Images

South African agricultural exports had been up for the third consecutive yr in 2022, reflecting beneficial manufacturing circumstances and better commodity costs. The export numbers for the complete yr haven’t but been revealed. I’ve calculated the annual information for 2022 utilizing quarterly commerce export statistics revealed by Trade Map, a commerce statistics portal developed by the International Trade Centre, the United Nations Conference on Trade and Development and the World Trade Organisation.

The main export crops continued to be maize, wine, grapes, citrus, berries, nuts, apples and pears, sugar, avocados, and wool.

These merchandise have been the drivers of exports over the previous couple of many years. In specific, fruit and wine have more and more develop into the main export merchandise. These have pushed an increase within the worth of agriculture (and agro-processing) exports, which have averaged 11% of the South Africa’s total exports, up from 9% within the decade earlier than.

South Africa now exports roughly half of its agricultural produce in worth phrases. Citrus, desk grapes, wine and a variety of deciduous fruits dominate the export listing. Increasingly, we’re seeing the encouraging uptick in beef exports.

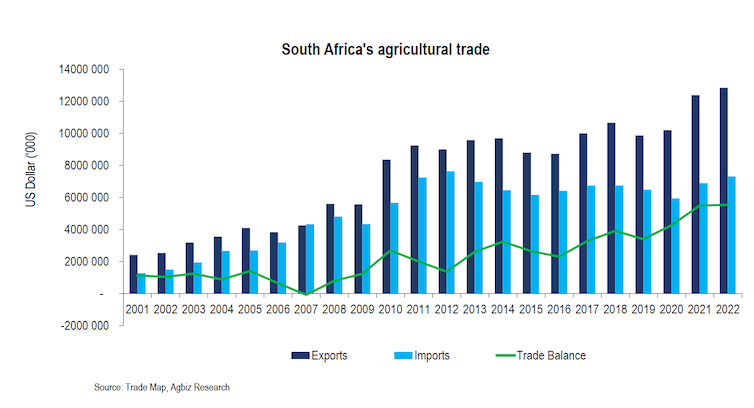

These sturdy exports have enabled South Africa to retain its place as a web exporter of agricultural merchandise over time. In 2022, South Africa’s agricultural exports reached US$12.8 billion, up 4% from the earlier yr.

Imports, however, stay vital, averaging US$6.6 billion over the previous 5 years. In 2022, the highest imported merchandise had been rice, palm oil, wheat, poultry and whiskies. These originated primarily from Asia, the European Union, the UK and the Americas.

Based on my calculations, utilizing Trade Map 2022 information, South Africa’s agricultural imports amounted to US$7.3 billion, up 6% from the earlier yr. Considering this import worth in opposition to the export worth of US$12.8 billion, South Africa’s agriculture realised a file commerce surplus of US$5.5 billion.

In view of this, focus ought to now be on growth of South Africa’s agricultural exports past its typical markets within the African continent, EU and elements of Asia, to new development frontiers. There is development in home manufacturing, and South Africa would require new markets for the increasing harvest.

The precedence international locations for increasing agricultural exports needs to be China, South Korea, Japan, the US, Vietnam, Taiwan, India, Saudi Arabia, Mexico, the Philippines and Bangladesh. All have sizeable populations and enormous imports of agricultural merchandise.

Who is shopping for South African?

My calculations utilizing Trademap information present that the African continent stays a number one market, accounting for 37% of South Africa’s agricultural exports in 2022.

These exports are concentrated inside the Southern African Development Community area. But my current analysis exhibits that South Africa’s agriculture export alternatives inside the African continent might be restricted resulting from structural challenges, stopping the agricultural sector from increasing its exports into untapped markets. This is regardless of the hope that’s been positioned on the African Continental Free Trade Area.

Asia was the second-largest agricultural market, accounting for 27% of exports, adopted by the EU, accounting for 19%. The Americas area was the fourth largest, accounting for 7%, and the remaining 10% went to the remainder of the world.

Within the remainder of the world class, the UK, traditionally South Africa’s main marketplace for agricultural produce, was one of many main markets.

The merchandise of exports to those markets had been primarily the identical, with the African continent and Asia importing over two-thirds of maize harvests. Meanwhile, exports to different areas had been primarily fruit and wine.

Asia has seen a lot sooner development in exports over the previous six years, whereas the African continent and the EU have remained pretty secure.

Challenges

South Africa’s sturdy export earnings had been achieved within the face of assorted challenges in ports and key export markets.

For instance, at first of 2022, logistical challenges within the port of Cape Town disrupted the exports of desk grapes and different deciduous fruits. Thankfully, cooperation between Transnet and organised agriculture helped minimise the constraints, and opened up channels of communication that had been crucial for managing the circulation of exports and attending to urgent issues.

The Durban port, which handles about 60% of the nation’s exports and imports, confronted fewer challenges than the earlier yr. As a outcome, citrus exporters confronted a comparatively higher export season from a logistics perspective. The smoother circulation of agricultural exports by Durban was additionally led to by elevated cooperation between organised agriculture and Transnet.

Credit ought to go to organised agriculture groupings, the federal government, Transnet and varied logistical teams that labored tirelessly to make sure a circulation of merchandise to export locations. While there are nonetheless many challenges inside logistics, Transnet’s willingness to cooperate intently with the agricultural neighborhood has helped enhance product circulation.

South African exports additionally confronted non-tariff limitations in some key export markets, resembling China for wool and the EU for citrus.

China briefly blocked South African wool in response to the outbreak of foot-and-mouth illness in South Africa.

This was a misstep on China’s half as there’s already a framework for coping with an outbreak of foot-and-mouth illness to make sure the protection of wool exports to China. Notably, the outbreak was on cattle, not sheep, which ought to have supplied additional consolation concerning the security of wool exports.

China lifted the ban after about 4 months. However, it had already had a notable monetary influence on South African wool farmers and exporting companies. China accounts for simply over 70% of South Africa’s wool exports.

For its half, the EU imposed protectionist measures on South Africa’s agriculture by altering its regulation on plant security for citrus with out notifying its buying and selling companions in cheap time.

The new regulation purports to guard the EU from a quarantine organism, “false codling moth”, by introducing stringent new chilly remedy necessities, notably on citrus imports from Africa, primarily affecting South Africa, Zimbabwe and Eswatini. This was a contentious concern, particularly as South Africa had already put rigorous measures to regulate the moth, which the EU used as a pretext to limit citrus imports from Africa.

Focus areas

Given that South Africa’s agriculture is export-orientated, the main focus needs to be on sustaining easy relations with present crucial export markets whereas looking for extra new markets.

This is especially vital within the context of rising tensions between the east and the west, particularly the US and China.

South Africa has to take care of open and friendlier relations with each groupings because the exports of agriculture are evenly unfold throughout these areas.

![]()

Wandile Sihlobo is the Chief Economist of the Agricultural Business Chamber of South Africa (Agbiz) and a member of the Presidential Economic Advisory Council (PEAC).